De: R$ 0,00Por: R$ 138,09ou X de

De: R$ 0,00Por: R$ 138,09ou X de

| Selo | Inverse Books |

|---|---|

| Edição | 0 |

| Idioma | Inglês |

| Autores | Mark Tier |

| Acabamento | Capa Comum |

| Quantidade de Páginas | 278 |

| Origem | Literatura Estrangeira |

A vista do topo (2005)

A vista do topo (2005)

BUZZ EDITORA

R$ 49,90 à vista Como não ser uma vendida (2005)

Como não ser uma vendida (2005)

BUZZ EDITORA

R$ 59,90 à vista Hypothesis-Driven Development

Hypothesis-Driven Development

Cook & McDouglas

R$ 198,69 ou até 3x sem juros Course Creation Simplified

Course Creation Simplified

Jimmy Naraine

R$ 128,00 ou até 2x sem juros The Almanack of Stanley Druckenmiller

The Almanack of Stanley Druckenmiller

Upgraded Publishing

R$ 154,95 ou até 3x sem juros The ABM Effect

The ABM Effect

Momentum ITSMA

R$ 134,56 ou até 2x sem juros Inteligência competitiva e estratégia empresarial

Inteligência competitiva e estratégia empresarial

KS OmniScriptum Publishing

R$ 390,72 ou até 3x sem juros Stakeholder Engagement Essentials You Always Wanted To Know

Stakeholder Engagement Essentials You Always Wanted To Know

Vibrant Publishers

R$ 327,39 ou até 3x sem juros Disrupt Disruption

Disrupt Disruption

New Degree Press

R$ 123,13 ou até 2x sem juros Finance for Development

Finance for Development

Rowman & Littlefield Publishing Group Inc

R$ 276,73 ou até 3x sem juros An Essay On Abstinence From Animal Food

An Essay On Abstinence From Animal Food

Legare Street Press

R$ 169,29 ou até 3x sem juros The Future of Purpose-Driven Branding

The Future of Purpose-Driven Branding

Morgan James LLC (IPS)

R$ 126,58 ou até 2x sem juros Trading de la Acción del Precio Tendencias

Trading de la Acción del Precio Tendencias

Draft2Digital

R$ 416,85 ou até 3x sem juros Meet Me On the Bridge

Meet Me On the Bridge

Manuscripts LLC

R$ 132,54 ou até 2x sem juros Stuck? Diagrams Help.

Stuck? Diagrams Help.

Lulu Press

R$ 275,64 ou até 3x sem juros Finanças para Compras: Domine técnicas e ferramentas para melhores resultados em Suprimentos

Finanças para Compras: Domine técnicas e ferramentas para melhores resultados em Suprimentos

Um Livro

R$ 62,90 à vista O milionário de amanhã começa hoje: Como fazer Fortuna com 300 reais

O milionário de amanhã começa hoje: Como fazer Fortuna com 300 reais

Ases da Literatura

R$ 54,90 à vista Como não ser uma vendida (2005)

Como não ser uma vendida (2005)

BUZZ EDITORA

R$ 59,90 à vista Como não ser uma vendida (Livro com brinde) (2005)

Como não ser uma vendida (Livro com brinde) (2005)

BUZZ EDITORA

R$ 59,90 à vista Smart Money Concept

Smart Money Concept

Marcus Blackwell

R$ 140,53 ou até 2x sem juros Hypothesis-Driven Development

Hypothesis-Driven Development

Cook & McDouglas

R$ 198,69 ou até 3x sem juros The 2-Hour Workshop Blueprint

The 2-Hour Workshop Blueprint

Big Charlie Press

R$ 138,78 ou até 2x sem juros Course Creation Simplified

Course Creation Simplified

Jimmy Naraine

R$ 128,00 ou até 2x sem juros Winning the Week

Winning the Week

Houndstooth Press

R$ 125,20 ou até 2x sem juros The ABM Effect

The ABM Effect

Momentum ITSMA

R$ 134,56 ou até 2x sem juros Treating People Not Patients

Treating People Not Patients

Ethos Collective

R$ 132,26 ou até 2x sem juros The Failure of Judges and the Rise of Regulators

The Failure of Judges and the Rise of Regulators

Random House

R$ 197,20 ou até 3x sem juros Organizar para a Complexidade. Como fazer o trabalho funcionar de novo, para criar organizações de alto desempenho

Organizar para a Complexidade. Como fazer o trabalho funcionar de novo, para criar organizações de alto desempenho

Follett Publishing

R$ 121,78 ou até 2x sem juros Value, Historicity, and Economic Epistemology

Value, Historicity, and Economic Epistemology

Springer Nature B.V.

R$ 346,52 ou até 3x sem juros Stuck? Diagrams Help.

Stuck? Diagrams Help.

Lulu Press

R$ 275,64 ou até 3x sem juros O milionário de amanhã começa hoje: Como fazer Fortuna com 300 reais

O milionário de amanhã começa hoje: Como fazer Fortuna com 300 reais

Ases da Literatura

R$ 54,90 à vista Como não ser uma vendida (Livro com brinde) (2005)

Como não ser uma vendida (Livro com brinde) (2005)

BUZZ EDITORA

R$ 59,90 à vista Hypothesis-Driven Development

Hypothesis-Driven Development

Cook & McDouglas

R$ 198,69 ou até 3x sem juros Crimes Against Data

Crimes Against Data

Technics Publications

R$ 233,11 ou até 3x sem juros Course Creation Simplified

Course Creation Simplified

Jimmy Naraine

R$ 128,00 ou até 2x sem juros The Almanack of Stanley Druckenmiller

The Almanack of Stanley Druckenmiller

Upgraded Publishing

R$ 154,95 ou até 3x sem juros The ABM Effect

The ABM Effect

Momentum ITSMA

R$ 134,56 ou até 2x sem juros Stakeholder Engagement Essentials You Always Wanted To Know

Stakeholder Engagement Essentials You Always Wanted To Know

Vibrant Publishers

R$ 327,39 ou até 3x sem juros Five Brain Leadership

Five Brain Leadership

Page Two Press

R$ 167,42 ou até 3x sem juros Finance for Development

Finance for Development

Rowman & Littlefield Publishing Group Inc

R$ 276,73 ou até 3x sem juros Ichimoku Trading

Ichimoku Trading

Trade Stalker

R$ 100,69 ou até 2x sem juros Secrets of Closing the Sale

Secrets of Closing the Sale

Baker Publishing Group

R$ 178,73 ou até 3x sem juros A Espiritualidade na Angariação de Fundos

A Espiritualidade na Angariação de Fundos

GNP Global Nazarene Publications

R$ 70,35 à vista The 2-Day-CEO

The 2-Day-CEO

Rise Up Kings Inc

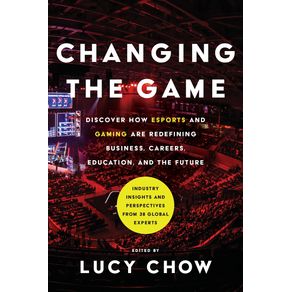

R$ 140,87 ou até 2x sem juros Changing the Game

Changing the Game

Greenleaf Book Group

R$ 122,70 ou até 2x sem juros